How to Compare a Business Loan Offer: What to Look For Before You Sign

Choosing the right business loan isn’t only about getting approved — it’s about making sure the offer truly supports your business. Interest rates, fees, collateral, and repayment terms can vary widely between lenders, and a small difference on paper can mean a big cost over time.

Here’s a practical guide to help you compare loan offers effectively and avoid common pitfalls.

1. Interest Rate vs. APR — Know the Real Cost

When lenders show you an interest rate, it may look attractive, but it often doesn’t tell the full story.

APR (Annual Percentage Rate) is what really matters — it includes both the rate and the fees.

Questions to ask:

Is the rate fixed or variable? How often can it change? Is the APR clearly disclosed?

Even a difference of 1–2% in APR can add up significantly over several years.

2. Understand All Fees (They Add Up Fast)

Fees can sometimes cost more than the interest itself. Always identify:

Origination fees Processing fees Document fees Late fees Prepayment penalties Draw fees (for lines of credit) Hidden administrative charges

If a fee is unclear, ask the lender to show exactly where it appears in the contract.

3. Evaluate the Repayment Structure

The repayment plan determines your cash flow burden. Review:

Monthly payment amount Duration of the loan Balloon or lump-sum payments Whether daily or weekly repayments are required (common with online lenders) Whether early payoff reduces total cost

Ask for a full amortization schedule and check if the numbers match what was promised.

4. Collateral & Personal Guarantees

Many loans require collateral, such as equipment, inventory, real estate, or business assets. Some lenders also require a personal guarantee, meaning your personal assets may be at risk.

Important considerations:

Is collateral proportional to the loan size? Is the guarantee standard for your type of loan? What happens in a default scenario?

Always understand what you’re putting on the line.

5. Check Lender Reputation and Transparency

Not all lenders operate the same way. Before committing, check:

Independent reviews Complaints or regulatory actions Experience with small businesses How transparent they are about fees and terms

A reputable lender will happily explain every part of the offer.

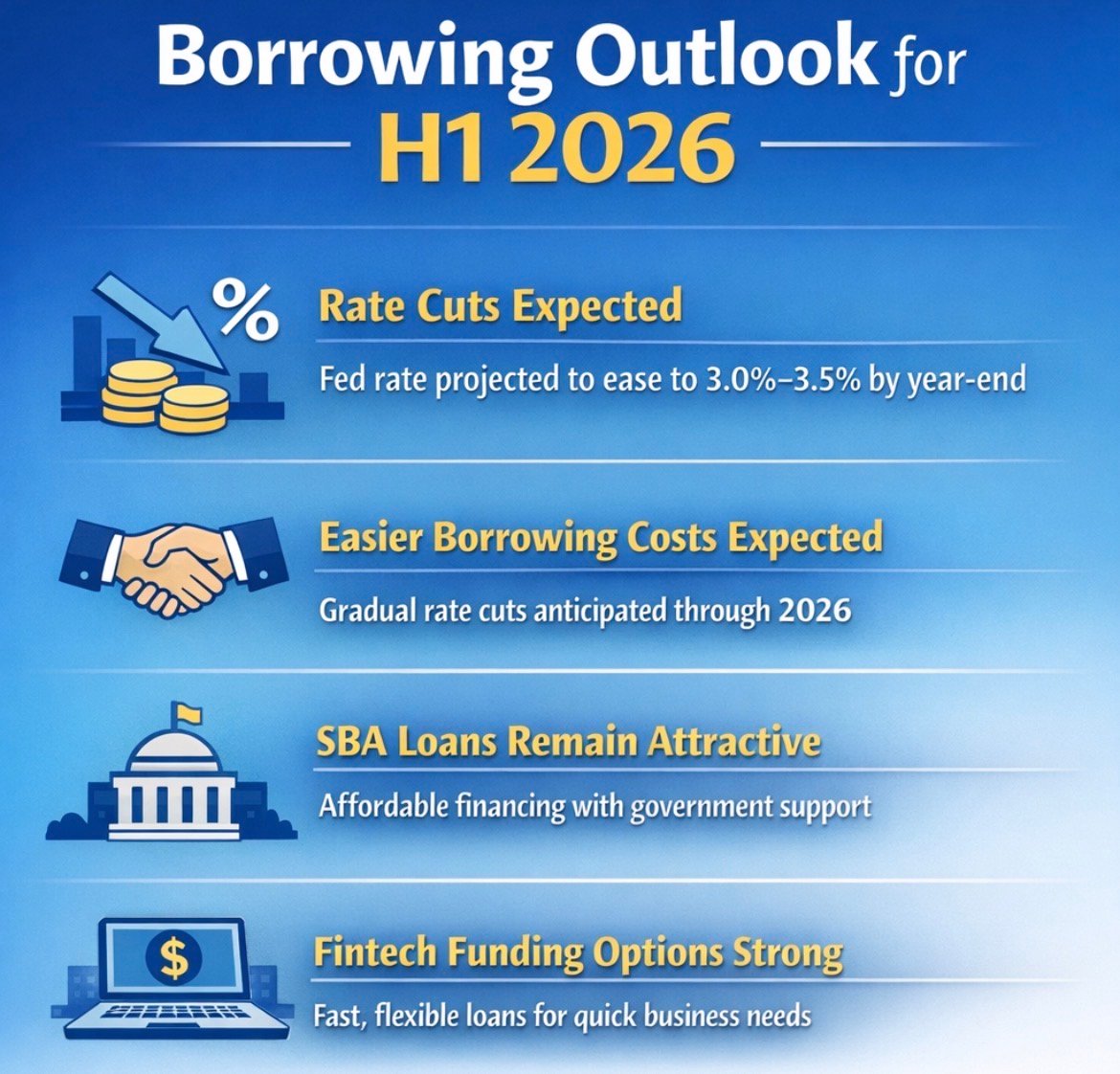

6. Current Business Loan Rates in the U.S. (2025)

Here’s a quick overview of typical APR ranges across loan types:

- Traditional Bank Term Loan: 6.7%–11.5% p.a.

- SBA 7(a) Loan: 10.5%–15.5% (variable/fixed)

- Business Line of Credit: 10%–99% APR (wide range)

- Online / Short-Term Loan: 14%–99% APR

- Equipment Financing: 4%–45% APR

- Invoice Factoring: 10%–79% APR

- Merchant Cash Advance: 40%–350% APR

These ranges vary based on credit, revenue, time in business, and lender risk evaluation.

7. What to Compare Side-by-Side

When reviewing two or more offers, compare:

APR Total repayment cost Monthly cash flow impact Collateral and guarantees Fees (especially prepayment penalties) Funding speed Lender reputation

A good loan supports your business goals — it doesn’t strain them.

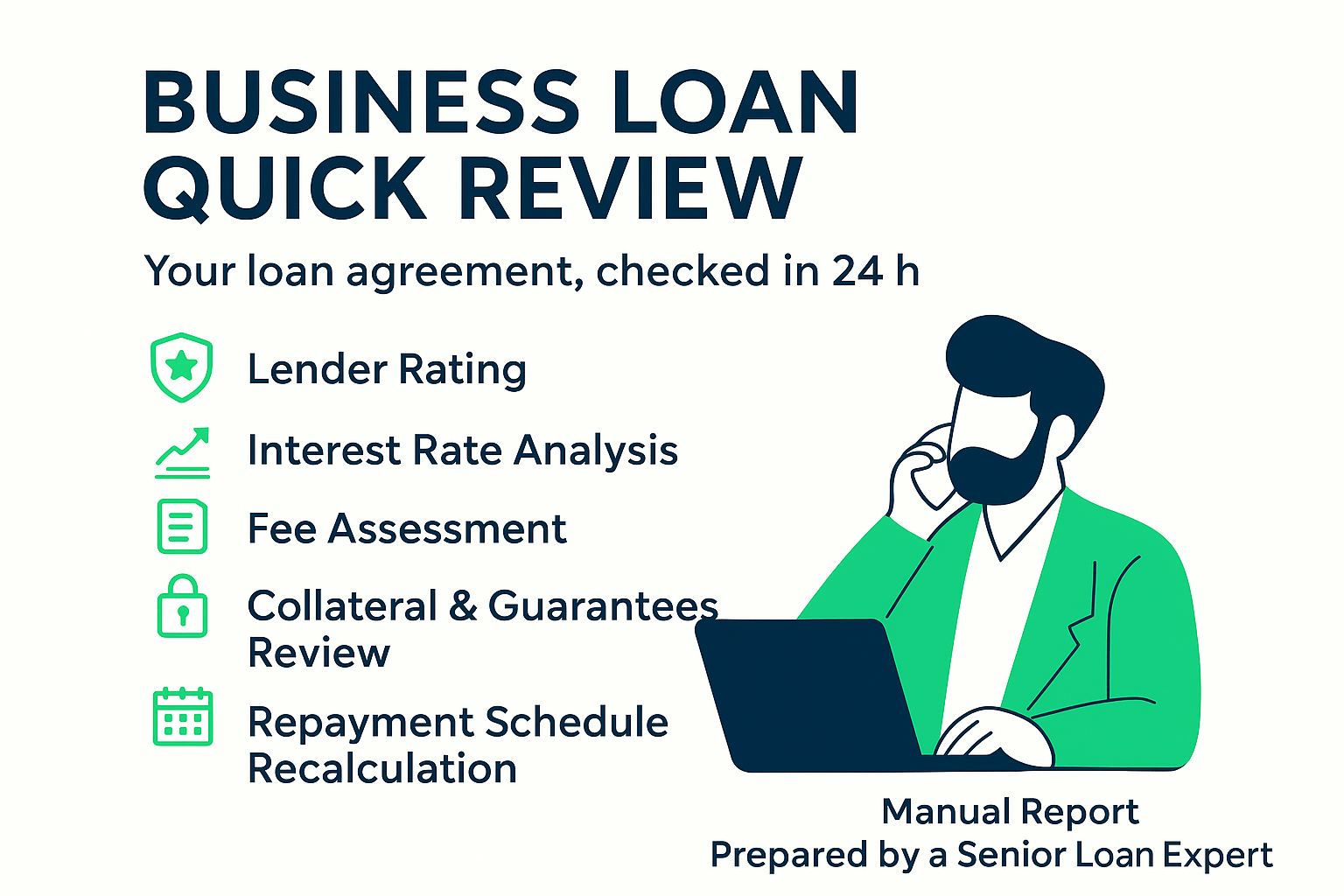

8. Why a Professional Second Opinion Helps

Loan agreements can be long, complex, and filled with terms that look simple but have real financial consequences. Many small business owners now use independent services that review loan offers and provide a clear summary of the key points.

One example is Business Loan Quick Review, which offers:

A manual loan offer analysis by a senior loan expert Clear summary (1–4 pages) Review of interest rate, fees, collateral, guarantees, and repayment schedule Delivery within 24 hours Fixed price $199

Getting a second opinion can prevent costly mistakes and help you sign with confidence.

👉 Learn more: https://loan-comparison.com/product/business-loan-quick-review/